The evolution of digital technology at a rapid pace is affecting how consumers tend to make their purchasing decisions. As a result, businesses from all sectors are updating and redesigning their digital marketing strategies to keep up with the changing trends. Companies in the financial sector are no exception in this regard. Consumers are increasing their consumption of content across several digital platforms. A tech-forward digital marketing strategy for financial institutions with data integration will transform how companies attract and sell to customers. Companies functioning in the financial sector are seeking assistance from organic SEO companies to build an effective digital strategy to communicate with their clients. Digital marketing for financial services helps improve visibility and customer perception, boost engagement, and increase target audience.

Key Benefits of Digital Marketing for Finance and Banking Institutions

As per 2021 statistics from marketing resource Ruler Analytics, the average customer conversion rate for financial services is 4.3 percent. Without digital marketing, financial service companies could be missing out on a huge share of the target audience. Digital marketing involves utilizing several advanced strategies within the digital or online sphere to achieve the goals of the financial organization. Here discussed are some of the key benefits of digital marketing for financial services –

- Build Brand Awareness and Trust – Digital marketing strategies focus on personalizing and enhancing the customer service or experience, thereby generating trust in the existing audience group. Redesigning the website with the user experience in mind and focusing on diverse areas of digital marketing such as -content marketing, email marketing and social media platforms can pay dividends for financial services companies. This helps generate brand awareness and you can build on that brand awareness. When leads or clients get a feel like they recognize your brand even if they have never done business with you earlier, an inherent sense of trust is built. This trust can be increased throughout the customer journey to cinch a conversion.

- Generate New Leads – As a financial service company prioritizes digital marketing, you will notice an influx of traffic to your website, social media pages, and the email list might begin filling up as well. Some of the qualified leads could lead to a higher rate of conversions.

- Enhanced Engagement with the Audience – When compared to other sectors, the financial services industry is perhaps not the most engaging. However, with an improved marketing strategy, it is possible to continually find innovative ways to connect with the target audience. In fact, this could be through a highly personalized drip email campaign, gripping social media content, whitepapers and blog posts, email newsletter content, or a website.

- Track the Audience Progress – As and when a digital marketing campaign for a financial organization starts, you can track how an average client transforms from an inquisitive lead to a loyal customer. This can help better understand how a lead locates a financial company and enquires about their process. This in turn will help better accommodate clients on their way through the sales funnel, so they have a greater likelihood of sticking around until they convert and then for a good deal of time afterward.

Designing a Digital Marketing Campaign for Financial Services – Key Strategies

The prevalence and growth of mobile technology and e-commerce technologies are rapidly changing the modern consumers’ day-to-day habits and preferences. People now prefer online agencies to get the products and services they want. The more comfortable people become with working and functioning digitally, the more they trust the technology involved. In fact, many customers nowadays manage their finances and various accounts online. They are using social media to research new products and services that may meet their needs. Financial services firms that are successfully embracing these new changes aren’t just tapping into new markets. They are better at meeting the expectations of their current clients and retaining their business as well. Reports suggest that more than 62 percent of financial service provider calls are driven by organic search results and it’s time to focus on the SEO aspect. Here discussed are some key digital marketing trends or tips for financial service providers –

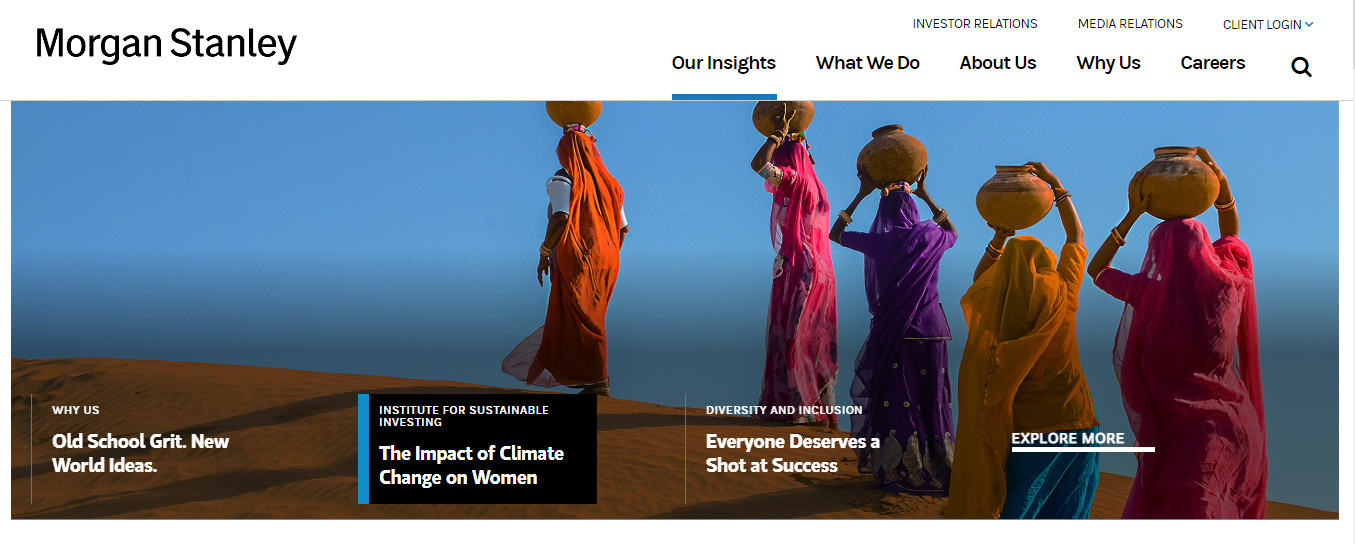

- Content Marketing – Creating a solid content marketing presence is an important strategy, when it comes to attracting the interest of the target demographic and stand out from the competition. Designing a solid content marketing campaign can help drive traffic, generate leads and thereby, conversions. In addition, it is a great way to set a company apart from the rest as a proper industry authority – something especially beneficial for finance businesses. Content marketing is central to any digital marketing strategy for banks as it presents opportunities to grow relationships and build trust with customers. Content marketing strategies comprise blogs, case studies, print media, videos and various other forms of media. Striking the perfect balance between informative and straightforward, engaging and informative content is also crucial.

- Establish a Social Media Presence – Modern clients are increasingly turning to social media platforms for help with their investment and purchase decisions. Reports suggest that around 81 percent of Americans are active on social media and spend an average of 4-5 hours a day utilizing it in various aspects to research products, contact businesses, and follow brands that they are interested in. Large retail banks and other financial institutions can seem too impersonal to customers. Social media engagement is smart for search engine optimization purposes as well as for reaching communities with information about events and specials. Building a striking social media profile, filling feed with the right content, and interacting with customers via social media are powerful marketing strategies that can be adopted.

- Chatbots – Financial services companies that aim to improve their digital transformation and grow relationships with their customers (especially the younger generation) can benefit from chatbots. With a chatbot, you can more efficiently answer customer queries. A chatbot bridges the gap and can answer questions, address complaints, and keep customers patient until a banker or accountant is back in the office to speak with them.

- Video Content and Advertising – Video content has become increasingly valuable and most of the content shared online via social media has some sort of video. YouTube is currently the second most popular search engine after Google that claims more than 80 percent of all web traffic. If a financial brand is not using video for advertising campaigns or for offering financial education, it is important to reconsider this aspect and integrate the same into the digital marketing strategy.

- Video Conferences and Webinars – Webinars and educational videos are highly valuable forms of content that will help a financial firm align with the depths of a financial concept. These are also a great way to generate new leads. Video conferences and webinars help schedule internal subject matter experts and guests to bring information to prospects and existing customers. As a financial brand creates more webinars, recorded archives can be kept in an easy-to-access web library. An esteemed portfolio of webinars offers customers a repository of information they will return to.

- Personalization of Customer Experience – According to a 2021 study published in Business Wire by Capco (that surveyed 1000 customers) – about 72 percent of the respondents considered personalization a highly important factor. Every digital marketing strategy for banks should include personalized product suggestions and offerings using Big Data. Large retail banks and financial institutions utilize machine-learning personalization, real-time personalization (that relies on historical and real-time data), or prescriptive personalization (that uses historical data) to personalize emails, blog content, and social media content.

- Data-driven Digital Marketing for Banks – Data integration allows marketers from financial institutions to analyze how well an ad campaign or piece of content is performing. Social media, emails and website analytics tend to generate huge amount of data. There are many platforms that will make sense of data trends to guide marketers. The right mix of automation and content creation can give salespeople targeted insights.

- Use Personal Stories to Boost Connection – Most clients expect more from the brands that they trust. When it comes to getting through to existing and potential customers, cold and impersonal doesn’t seem to be effective anymore. People want to build a personal connection with the financial firm they engage with. So, add engaging stories to the mix to drive engagement and build rapport. Share informative or compelling finance stories on events related to your financial company or industry.

- Customer Reviews – It is estimated that about 98 percent of customers read reviews from other customers before pulling the trigger on a purchase decision they are considering. Reviews become even more important for financial companies, as people want to be extra sure of the services they will be trusting with their money. When it comes to digital marketing for financial services, a good review from a happy, satisfied customer can be highly effective. Reviews offer a platform to show customers how responsive, caring, efficient, and accountable a financial company is. Ensure that the Google Business Profile of your company is complete. Leave a reviews section open on sites like Facebook or email links to your customers to leave a review after an interaction. Even negative reviews can be turned to a smart business owner’s advantage. Use this as an opportunity to show customers how responsive, caring, efficient, and accountable your financial company is.

- Consider Mobile Compatibility – Nowadays, most people do at least some of their purchase browsing and shopping via their smartphones. Make sure to optimize company websites, blogs, and purchasing interfaces for mobile devices. Consider clean designs, lightning-quick load times, and intuitive navigation. Revise the marketing strategies to better reach customers via mobile technology.

- Email Marketing – Email marketing is another important digital marketing strategy for financial organizations. As email is an excellent communication tool, you can send customers monthly or quarterly newsletters. Financial organizations provide exclusive offers on mortgages or life insurance through email as well as use it as a tool to inform customers of any changes or additional services that they offer. Emails can lead to more conversions as well. An automated drip email campaign can be used to guide a lead through the funnel. While it is possible to reply to leads in real-time, the bulk of the emails they receive would be time-based according to the actions they take.

There is tremendous competition in the digital marketing field among all industries and the financial industry is no exception in this regard. With tremendous evolution in the field of digital marketing, staying on top or remaining up-do-date with the trends can be challenging for financial institutions. Adhering to the above-mentioned strategies can help to some extent in this regard. Digital marketing for financial services is critical for building customer engagement, generating more leads, strengthening the brand, and increasing sales. Another practical option is to consult a professional digital marketing agency for financial services. Such agencies can provide the services of digital marketing specialists who remain well updated with the latest digital marketing trends.

A leading search engine optimization company based in the United States, MedResponsive provides high-quality SEO services for every industry.

Call (800) 941-5527 for a FREE consultation!